GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Please login using your email address as it is mandatory to access all the services of community.data.gov.in

GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Property tax is the annual amount paid by a land/property owner to the local government or the municipal corporation of his area. The property includes all tangible real estate property, his house, office building and the property he has rented to others.

In India, the municipal corporation of a particular area assesses and imposes the property tax annually or semi-annually. In Surat, citizens are required to pay property tax is annually. The calculation of Property Tax is done based on Area based assessment which includes the area, construction, property size, building etc. Property tax is considered as one of the major source of revenue for Municipal Corporations. Hence it is important for municipal corporations to ensure that tax recovery is higher. The property tax bill also includes various user charges which are listed below:

For better administration, Surat Municipal Corporation has divided the city area in 8 (Eight) zones and zones are further divided into wards and sub wards. Surat Municipal Corporation has taken various measures to increase property tax recovery. Citizens can make payment of their Property Tax through various modes listed as under:

Citizens are offered 10% rebate on Property Tax component during month of April and 7% rebate is offered on Property Tax component during month of May. If the payment is made using a digital mode (i.e. Through Credit Card / Debit Card / Net Banking / Wallets etc.) additional 2% discount is offered to citizens on payment of Property Tax. After completion of advance tax payment period (April and May) sub-ward wise bills are issued to citizens intimating them to make payment of their Property Tax. Once, the bills are issued, it is important for city administration to monitor Property Tax recovery of entire city. To help the city administration in better monitoring and management of Property Tax, Surat Municipal Corporation has utilized various IT components which help them in better decision making and resource utilization.

For the efficient monitoring and management of municipal services it is important that authorities makes sense of the data received from respective domain system to get intelligent insights through systems. This makes it easy for the various departments to identify potential problems and take corrective actions promptly and efficiently. Delivered through an interactive interface, this helps stakeholders leverage information with near real-time visibility to critical data helping them make informed decisions.

Key points to be considered as part of solution

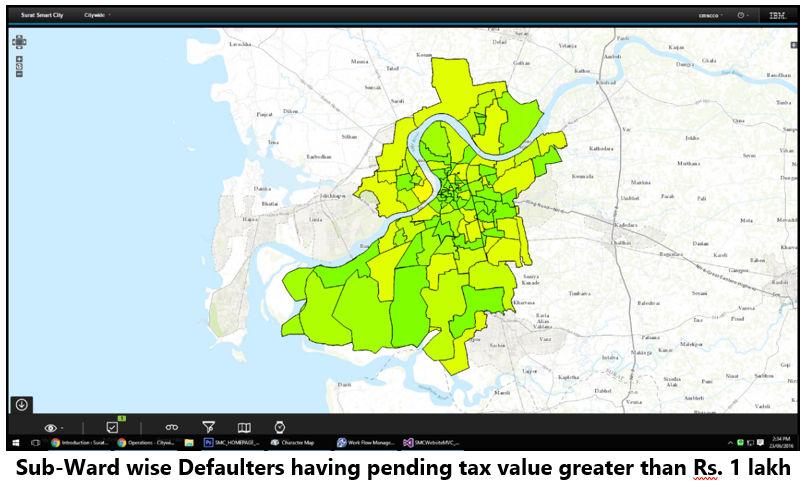

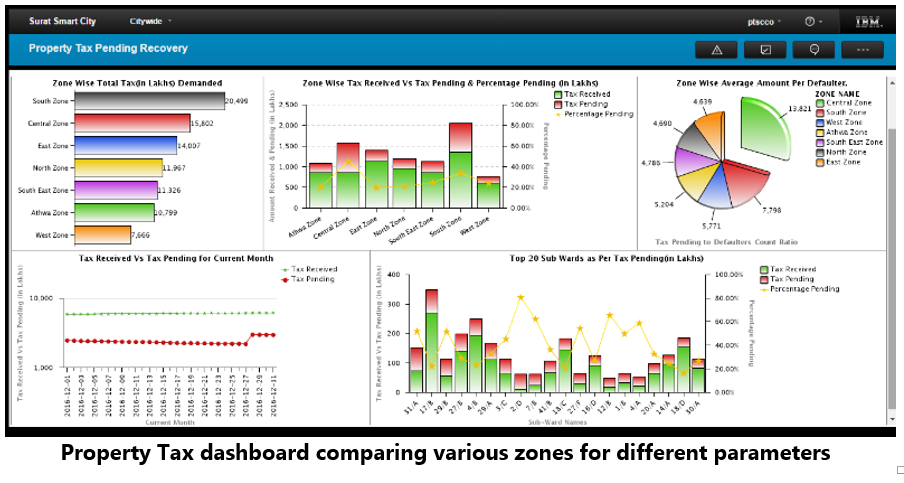

The data generated through Property Tax System along with Geo Coordinated boundaries of Zone, Ward and Sub-Wards are used for better monitoring and management of Property Tax System. City wide coloured maps are created on real time basis to understand the tax recovery patterns in the entire city area. The coloured maps are created based on various parameters as required for better administration of Property Tax System. Some of the parameters considered at Surat for Property Tax System are as under:

Legend

|

PTax Case -1: Defaulters Count – Threshold Values

|

|||||

|

Range in Rs.

|

Red

|

Yellow

|

Orange

|

Green

|

|

|

1

|

50,000.00

|

40%

|

30%

|

20%

|

10%

|

|

50,000.01

|

75,000.00

|

25%

|

22%

|

20%

|

18%

|

|

75,000.01

|

100000.00

|

20%

|

15%

|

13%

|

10%

|

|

1,00,000.01

|

5,00,000.00

|

15%

|

13%

|

10%

|

5%

|

|

Above 5,00,000

|

8%

|

6%

|

4%

|

2%

|

|

Legend

|

PTax Case-2: Property Tax Amount % Pending -Threshold Values

|

|||

|

0.01%

|

10.00%

|

No Action

|

Green

|

|

10.01%

|

25.00%

|

Later

|

Yellow

|

|

25.01%

|

40.00%

|

Imminent

|

Orange

|

|

40.01%

|

100.00%

|

Prompt

|

Red

|

The scenario shown above describes sub-ward wise pending recovery for property tax. This simple colour based representation of the system, helps city authorities to understand where immediate attention is required and whom to be notified to take necessary actions. This helps in only reviewing the area requiring attention rather than reviewing the entire city performance. Further, drilldown information is made available (list of tenements where tax collection is pending, concern SMC officer of the area etc.) for better administration. Provision to trigger SOP (Standard Operating Procedure) is provided to notify concern officers to take necessary action.

The scenario shown above describes sub-ward wise pending recovery for property tax. This simple colour based representation of the system, helps city authorities to understand where immediate attention is required and whom to be notified to take necessary actions. This helps in only reviewing the area requiring attention rather than reviewing the entire city performance. Further, drilldown information is made available (list of tenements where tax collection is pending, concern SMC officer of the area etc.) for better administration. Provision to trigger SOP (Standard Operating Procedure) is provided to notify concern officers to take necessary action.

Following graph describes the Property Tax collected for Financial Year 2015-16, 2016-17, 2017-18, 2018-19. One of the important factor for continuous increase in tax collection is also the additional monitoring using various datasets prepared under Open Data Initiative.

Legend

X Axis represents Financial Year

Y Axis represents Property Tax Collected in Crore

To implement such system following details are required: