GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Please login using your email address as it is mandatory to access all the services of community.data.gov.in

GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

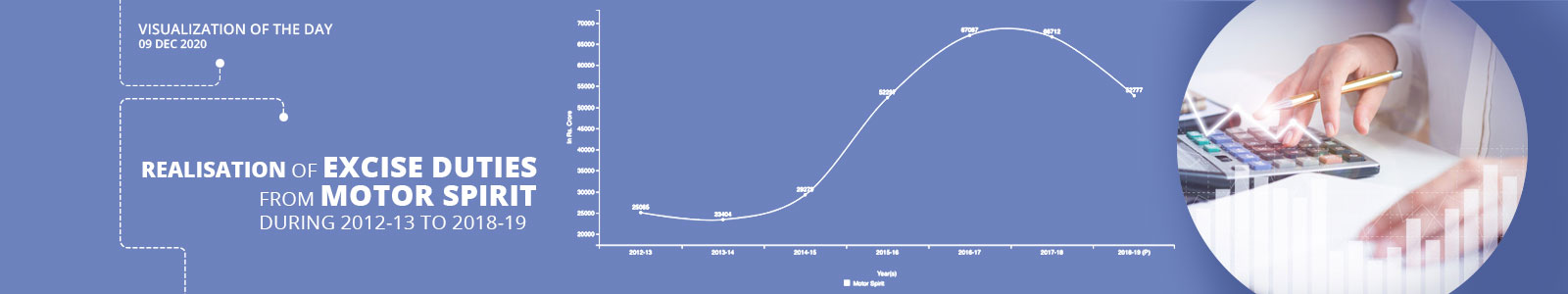

India has witnessed a volatile trend in realisation of excise duties from motor spirit during 2012-13 to 2018-19. However, we have observed compound annual growth rate of 13.21% in realisation of excise duties from motor spirit during the period under consideration.

Realisation of excise duties from motor spirit was Rs. 25,065 crore in 2012-13. It has shrunken by -6.63% to Rs. 23,404 crore during 2013-14 over 2012-13. Annual decline of -0.56% has been seen in realisation of excise duties from motor spirit during 2017-18 from Rs. 67,087 crore during 2016-17. Realisation of excise duties from motor spirit was Rs. 52,777 crore during 2018-19, down by -20.89% against Rs. 66,712 crore during 2017-18.

The maximum annual growth rate of 78.62% has been found in 2015-16 in realisation of excise duties from motor spirit during the period under consideration.

Note: Data value are in Rs. crore; P: Provisional; Excise and customs duty paid on crude oil and petroleum products on the basis of their respective Central Excise Tariff Heads (CETH) under chapter-27 excludes CETH 2701 to 2708 & 2716 which do not pertain to oil & gas sector; Source: Central Board of Indirect Taxes & Customs (CBIC).

Dataset URL: https://data.gov.in/resources/realisation-of-excise-and-customs-duties-from-crude-oil-and-petroleum-

Resource Title: Realisation of Excise and Customs Duties from Crude Oil and Petroleum Products from 2012-13 to 2018-19