GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Please login using your email address as it is mandatory to access all the services of community.data.gov.in

GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

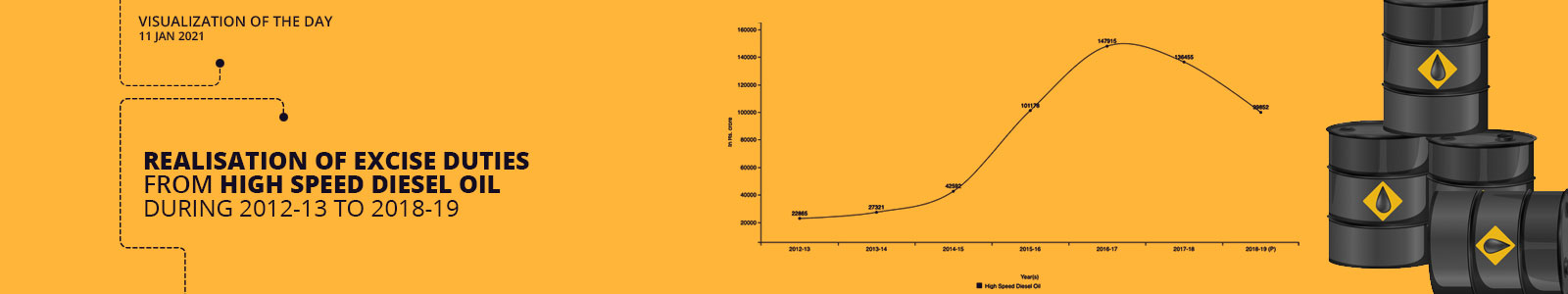

India has witnessed a volatile trend in realisation of excise duties from high speed diesel oil during 2012-13 to 2018-19. However, we have seen compound annual growth rate of 27.85% in realisation of excise duties from high speed diesel oil during the period under consideration.

Realisation of excise duties from high speed diesel oil was Rs. 22,865 crore in 2012-13. It has surged by 19.49% to Rs. 27,321 crore during 2013-14 over 2012-13. Annual decline of -7.75% has been observed in realisation of excise duties from high speed diesel oil during 2017-18 from Rs. 147,915 crore during 2016-17. Realisation of excise duties from high speed diesel oil was Rs. 99,852 crore in 2018-19, down by -26.82% versus Rs. 136,455 crore during 2017-18.

The maximum annual growth rate of 137.55% has been found in 2015-16 in realisation of excise duties from high speed diesel oil during the period under consideration.

Note: Data value are in Rs. crore; P: Provisional; Excise and customs duty paid on crude oil and petroleum products on the basis of their respective Central Excise Tariff Heads (CETH) under chapter-27 excludes CETH 2701 to 2708 & 2716 which do not pertain to oil & gas sector; Source: Central Board of Indirect Taxes & Customs (CBIC).

Dataset URL: https://data.gov.in/resources/realisation-of-excise-and-customs-duties-from-crude-oil-and-petroleum-

Resource Title: Realisation of Excise and Customs Duties from Crude Oil and Petroleum Products from 2012-13 to 2018-19