GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Please login using your email address as it is mandatory to access all the services of community.data.gov.in

GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Background:

New Town Kolkata Development Authority (NKDA) has implemented a paperless and online system of Property Tax assessment and collection. The Property Tax solution has been in place since 2nd April 2018 and is based on the Unit Area Assessment (UAA) system. The entire city has been divided into 34 areas, each accorded a specific identification category ranging from A to G, with a Base Unit Area Value (BAUV) in Rs/ sq. ft assigned to each category.

The non-assessment of Property Tax by property owners in New Town was leading to a significant loss of tax revenue for NKDA. In the context of this possibility, NKDA undertook the following initiative:

Pilot Study to understand correlation between Property Tax and Electricity connection

Pilot Study to understand correlation between Property Tax and Electricity connection

New Town Kolkata Development Authority (NKDA) and West Bengal State Electricity Distribution Corporation Limited (WBSEDCL) collaborated to conduct a pilot study to assess the number of properties that have not assessed or paid property tax, but are availing of facilities such as electricity connection.

The study involved collecting relevant WBSEDCL electricity meter data such as address of the property, date of meter connection, name of owner and contact details of the owner. The addresses and other details obtained were compared with the property tax database. The objective of the initiative was to determine the property owners who have availed electricity connection but not assessed and paid their property tax.

Ircon Towers situated at Street Number-70, Action Area-IA was selected as the test case for the property tax data analysis. Ircon Towers is a multi-storied residential complex with 3 towers and 62 housing units.

Figure 2: IRCON Towers housing complex, Action Area-I, New Town, Kolkata

Results Achieved:

It was observed that out of the 62 housing units at Ircon Towers:

1. 40 units had availed electricity connection from WBSEDCL and data related to them was reflected in the property tax database of NKDA.

2. However, 22 units had availed electricity connection from WBSEDCL but no data related to them was reflected in the property tax database.

Data related to these 22 properties such as contact details of house owners was extracted from the WBSEDCL database and the property owner was contacted. On cross verification with the house owners it was detected that the owners of these 22 properties had not assessed and paid their property tax. It was observed that out of these 22 housing units, 18 units were such whose owners resided outside the state or country and were not well versed with the property tax assessment and payment method.

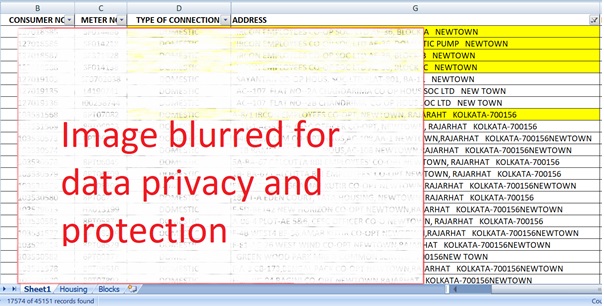

Figure 3: WBSEDCL Electricity Meter connection data for New Town Kolkata. The data for Ircon Towers is highlighted in yellow.

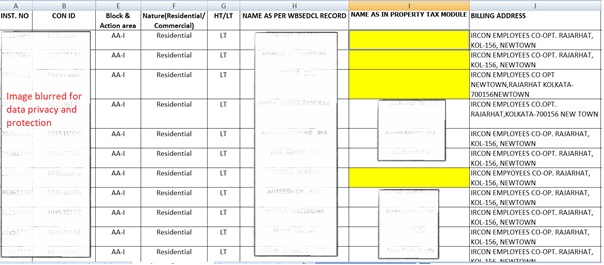

Figure 4: The WBSEDCL Electricity Meter connection data for properties in Iron Towers is combined in the above sheet with NKDA property tax database for Ircon Towers. The properties that have availed electricity connection but not assessed and paid property tax are highlighted in yellow.

Action Taken:

Basis the above data, the following actions were taken by NKDA:

The online system of Tax Collection enables property owners residing within and outside the state to seamlessly self-assess their property and pay their assessed taxes online.

Figure 1: NKDA website with property tax module. URL:https://www.nkdamar.org/Pages/AssessmentPropertyTax_new.aspx

Outcomes:

The sensitization campaign by NKDA bore fruit and over the next few days several property owners assessed and paid their taxes. As of 31st August 2021, 11 property owners had assessed and paid their taxes generating a revenue of Rs. 1,68,885 for NKDA which would otherwise have been lost. Attempts are on to assist the other property owners pay their taxes at the earliest.

With the resounding success of this pilot exercise, NKDA intends to collaborate with several other departments and reach out to a larger segment of the population residing in New Town and who have not assessed and paid their property tax. NKDA aims to prevent the revenue leakage that is existing and enhance its own source of funds for future sustainability.