GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Please login using your email address as it is mandatory to access all the services of community.data.gov.in

GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

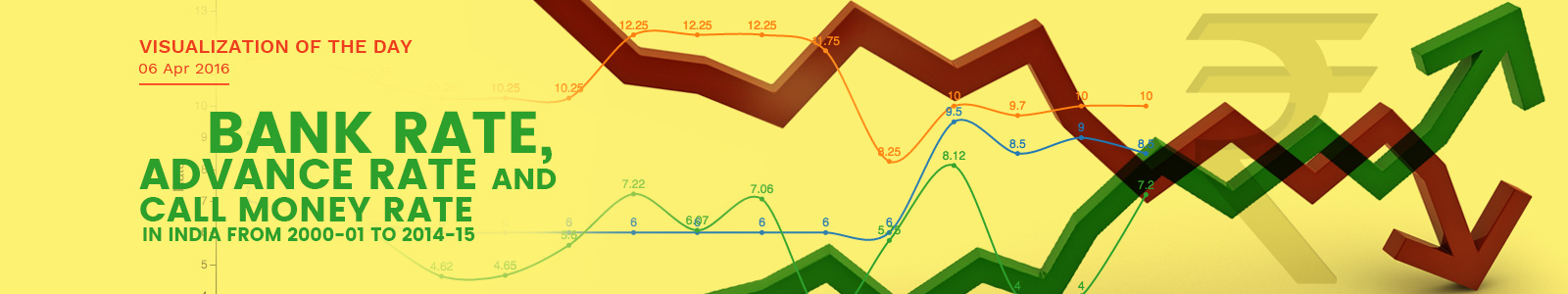

Money Rates – viz. Bank Rate, Advance Rate and Call Money Rate – in India have shown many ups and downs reflecting the prevailing domestic and global economic or financial conditions during the period from 2000-01 to 2014-15.

Bank Rate is the rate at which Reserve Bank of India lends funds to the banks. Though, of late, the emphasis is more on Repo rate as the main policy rate. Bank rate was on a downward trajectory during 2000-01 to 2003-04. Bank Rate declined from 7.00% in 2000-01 to 6.00% 2003-04. Thereafter, it remained stable at 6.00% during 2003-04 to 2010-11. It rose to 9.50% in 2011-12, declined to 8.50% in 2012-13, rose to 9.00% in 2013-14 and finally declined to 8.50% in 2014-15. These fluctuations are a result of the actions of RBI as the Monetary Authority.

Advance Rate is related to the lending rate of State Bank of India and is treated as a bellwether rate for the commercial bank lending. Advance rate was on a downward trajectory during 2000-01 to 2005-06. Advance Rate declined from 11.50% in 2000-01 to 10.25% in 2004-05 and remained stable in 2005-06. It rose to 12.25% in 2006-07. It declined to 11.75% in 2009-10 and further to 8.25% in 2010-11. It rose to 10.00% in 2011-12, but declined to 9.7% in 2012-13. It rose to 10.00% in 2013-14 and remained stable in 2014-15. Advance Rate has shown a trend somewhat similar to the bank rate.

Call/Notice Money Rate is the rate at which banks and financial institutions lend and borrow funds to/from each other for short periods in the Money Market. It reflects the liquidity (availability of money/funds) in the system and determines the short term cost of funds. Call/Notice Money Rate has inherent volatility and fluctuates widely as per the demand and supply conditions of the funds in the money market. However, as a long term trend, it shows correlation, though not of high degree, with Bank Rate or the policy Rates determined by the central bank of the country i.e. RBI in case of India. It showed downward trend during 2000-01 to 2003-04. Call/Notice Money Rate declined from 9.15% in 2000-01 to 4.62% 2003-04. Thereafter, it was fluctuating. It rose to 7.22% in 2006-07. It declined to 3.24% in 2009-10; rose to 8.12% in 2011-12 and again declined to 4.00% in 2012-13. Finally, it rose to 7.20% in 2014-15.

Note: NA: Not Available; Data for the year 2015-16 is as on end of July 2015; Call/Notice Money Rate for the year 2014-15 is the last traded rate in Call/Notice Money as on June 30, 2015; Reserve bank – bank rate and advance rate as on March 31; Advance Rate relates to SBI; Original Source: Reserve Bank of India and also published in statistical year book 2016 by MOSPI.