GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

Please login using your email address as it is mandatory to access all the services of community.data.gov.in

GOVERNMENT

OF INDIA

GOVERNMENT

OF INDIA

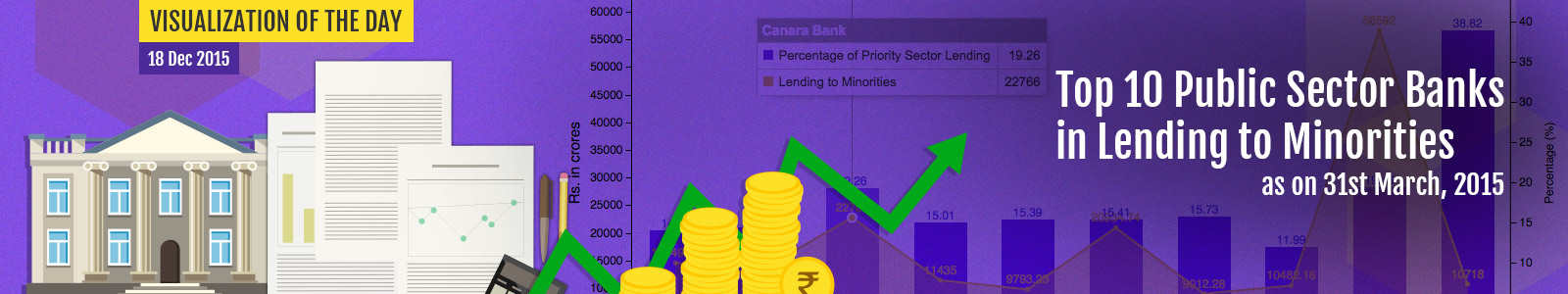

Banks have been contributing to the growth of the Priority Sector of India by extending credit to them on favorable terms, in accordance with the policies of the Government of India. The amount of lending to minorities by all the Public Sector Banks was Rs. 269644.19 crores as on 31-03-2015. The share of minorities community lending (MCL) outstanding was 15.84% of total Priority Sector Lending (PSL) by Public Sector Banks as on 31-03-2015.

Top 10 banks in lending to minorities under priority sector lending as on 31st March, 2015 were: State Bank of India, Canara Bank, Punjab National Bank, Bank of Baroda, Bank of India, Central Bank of India, State Bank of Travancore, Union Bank of India, Indian Overseas Bank and Syndicate Bank.

The amount of lending to minorities by State Bank of India was Rs. 56592 crores as on 31-03-2015. The share of minorities community lending (MCL) outstanding was 19.45% of total Priority Sector Lending (PSL) by State Bank of India as on 31-03-2015. The amount of lending to minorities by Canara Bank was Rs. 22766 crores as on 31-03-2015. The share of minorities community lending (MCL) outstanding was 19.26% of total Priority Sector Lending (PSL) by Canara Bank as on 31-03-2015. The amount of lending to minorities by Punjab National Bank was Rs. 20934.74 crores as on 31-03-2015. The share of minorities community lending (MCL) outstanding was 15.41% of total Priority Sector Lending (PSL) by Punjab National Bank as on 31-03-2015.

The amount of lending to minorities by Bank of Baroda was Rs. 14549.83 crores as on 31-03-2015. The share of minorities community lending (MCL) outstanding was 14.06% of total Priority Sector Lending (PSL) by Bank of Baroda as on 31-03-2015. The amount of lending to minorities by Bank of India was Rs. 13627 crores as on 31-03-2015. The share of minorities community lending (MCL) outstanding was 14.41% of total Priority Sector Lending (PSL) by Bank of India as on 31-03-2015.